Do you ever wonder how many mortgages you can have at once? In 2009, Fannie Mae updated its same borrower policy, amending the maximum number of conventional mortgages any one person can have from four to 10. However, qualifying and finding a lending institution that’ll give you more than four can be difficult.

In this post, we’ll discuss what’s required to have multiple mortgages (including an example), the pros and cons of having multiple mortgages, and how to manage them.

Real Estate Investing With Multiple Mortgages

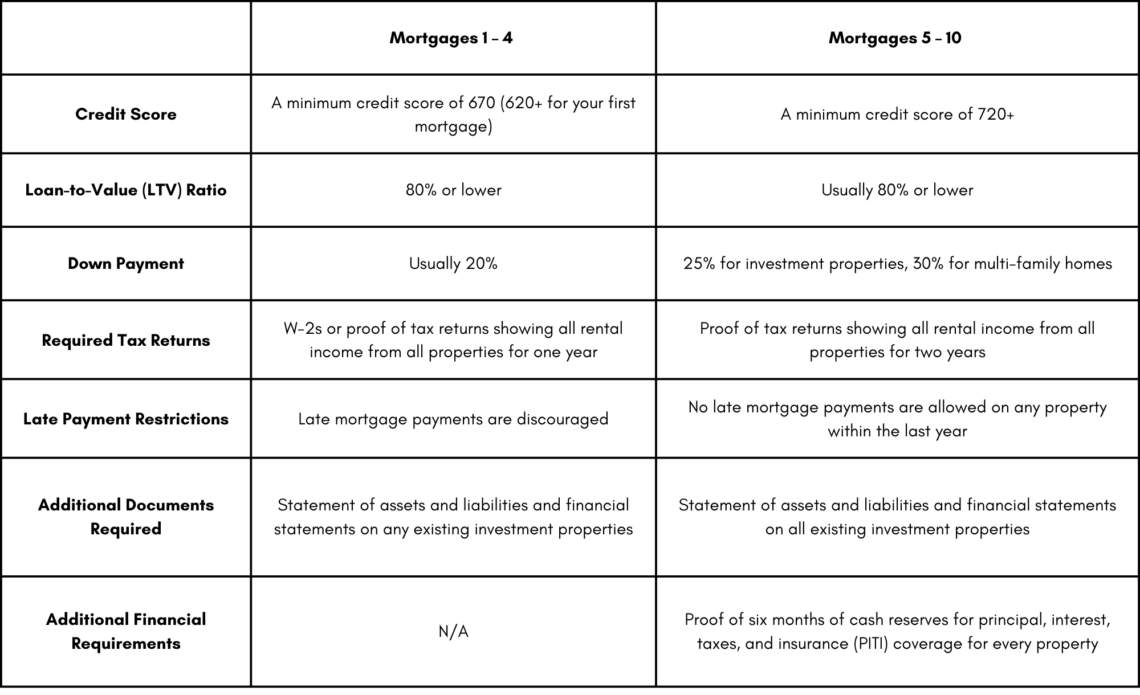

While you can take out up to ten mortgages, the qualifications become more strict after your fourth. Here’s a side-by-side comparison:

When shopping around, ask mortgage lenders about their additional loan requirements, if any.

Advantages of Having Multiple Mortgages

Having multiple mortgages comes with several benefits, including:

- More Rental Income: The more properties you rent out, the higher your rental income will be. One triplex can bring you $3,000/mo, and five could get you $15,000/mo.

- Easier to Achieve FIRE: More properties and bigger returns also mean you can achieve financial independence and retire early (FIRE).

- Larger, More Diverse Portfolio: Owning multiple properties allows you to expand into different neighborhoods and markets. You may discover that some aspects of your portfolio yield better returns than others and look for comparable properties.

- More Tax Benefits: Real estate investors can enjoy additional tax incentives when owning rental properties, including depreciation and cost segregation. These can help reduce your tax burden.

- Possibility of Combining: If you have multiple mortgages through the same lender or insurance company, you can sometimes combine all of your payments into a single payment, making tracking easier.

Complications of Having Multiple Mortgages

Managing multiple mortgages can have its downsides, too:

- Greater Loss Potential: The more properties you own, the more expenses you have. You can profit with rental income, but only so long as you have tenants willing to pay your desired rent, and vacancies, upgrades, and remodels all eat away at your profits.

- Harder to Manage: Managing ten properties usually takes more time than two. You need to put the extra time in or hire a rental property manager to do it for you.

- Requires Expertise: Renting a room or the bottom half of your duplex doesn’t require you to be an expert investor. The more properties you take on, the more you must know to ensure they’re all in good standing and well-maintained.

- Stricter Guidelines: Many lenders won’t offer you another conventional loan if you already have four, and those who do will have tougher requirements.

- More Paperwork: More mortgages usually means more of everything else—more bills, insurance requirements, liability, maintenance, legal documents to fill out, etc.

How to Manage Multiple Properties

Have processes that work for you already in place before expanding your portfolio. At the very least, you need a rent ledger to keep track of your tenants’ charges, balances, and monthly rent payments. Your ledger should also include information like the principal balance of each of your properties, payoff timelines, mortgage payment due dates, and notes outlining potential maintenance upgrade requirements.

It would help if you also created templates for anything you can think of to streamline your processes. The more you can automate, the more time you’ll spend on other tasks.

Also, don’t depend on your lenders to tell you when mortgage payments, insurance, and property taxes are due. It’s your responsibility to pay on time, not theirs. That said, keeping your payments from overlapping may be beneficial if you have multiple lenders for each of your properties. This will help you identify when and where your money is going.

Alternatives to Financial Multiple Mortgages

Affordability is often the most common barrier to having multiple mortgages. Qualifying for one loan is hard enough sometimes!

If you cannot secure a traditional loan for your next investment property, here are a few other options worth considering:

Hard money loans

Hard money loans are secured, short-term loans from private lenders or individuals. Instead of needing excellent credit and a low LTV ratio, hard money lenders accept tangible assets as collateral—often property. If you default on this loan, you risk losing that collateral.

Repayment periods for hard money loans are typically three months to a year but are longer. You can also expect to pay a higher interest rate for them, usually 10-12%.

Cash-out refinance

A cash-out refinance you to convert your home equity into cash, which you can use for your next investment. It’s a cornerstone of the BRRRR method and a great way to make extra cash without taking out a loan or paying interest.

Here’s how it works:

Suppose you have a mortgage loan for a $500,000 property paid down to $200,000. This means you have $200,000 remaining on your loan and $300,000 in equity. If you want to convert some of that $300,000 into cash, you can take out a new mortgage—let’s say for $250,000. Your new mortgage is $250,000, while the other $250,000 is cash in your pocket.

Portfolio loans

This loan is a type of mortgage a portfolio lender may offer. Rather than selling your investment portfolio to another company, your lender retains the portfolio loan in-house. This lets them establish more flexible mortgage terms, often to your benefit.

However, portfolio lenders are also opening themselves up to risk. Portfolio loans don’t have to meet conventional requirements, but if they don’t, these lenders cannot sell them on the secondary mortgage.

Blanket mortgages

Blanket mortgages let you finance multiple investment properties under the same mortgage agreement. These mortgages make the lives of real estate investors much easier because they have much less paperwork to keep track of.

Also, suppose you decide to refinance or sell one of your properties within your blanket loan. In that case, a clause “releases” the property from your original mortgage without disrupting the other properties under the “blanket.” This means that you don’t have to repay the entire loan.

Is Having Multiple Mortgages Right for You?

Owning more properties also means more work and increased expenses. If you lack that capacity, owning multiple properties may be more stressful than it’s worth if you lack that capacity.

However, taking out multiple mortgages can result in substantially higher returns if you have investment experience and a sound business strategy. Are you ready to expand your real estate portfolio? Check out more of our expert tips and strategies regarding investing in real estate.

Leave a Reply